CNBC Panel Freaks Out At The Suggestion That Predatory Lending Happened At Any Time Ever (VIDEO)

Tavakoli even moderates her comment, telling the other CNBC boxes that there is "plenty of blame to go around" in the housing crisis, but no matter! As soon as she reports that people "were preyed upon," Larry

Kudlow and Melissa Francis just go nuts, pretending as if the entire

lending industry was not "set up to be more profitable when loans fail." And check out Tavakoli's blog, in which she brilliantly dissects the absurdity of her co-panelists' arguments on the show.

Chittum goes to Francis's back catalog and makes a hilarious pull:

Francis used to be on Little House on the Prairie and I wondered if that moralizing show had any lessons on banking for us. Sure enough, this from Episode 43:Charles approaches the banker for a loan so he can buy a "new" set of dishes for Caroline. The banker declines because Charles does not have the collateral to back up the loan, so Charles goes to

work for the woman who is selling the dishes and trades his labor for

the china.

Lesson: Taking on debt for a want is almost never a good idea. The banker asks if this loan is for a need or a want. When Charles is forced to admit that here (sic) merely wants the dishes, the banker

tells him that borrowing money for non-necessities is not a good idea

and that he's doing Charles a favor by declining the loan.

Needless to say, this is the antithesis of what lending was like in the bubble.... Presumably, Francis thinks Angelo Mozilo's Countrywide settled a predatory-lending lawsuit against it for $8.7 billion because it just wanted to get on with business, not because it actually preyed on consumers.

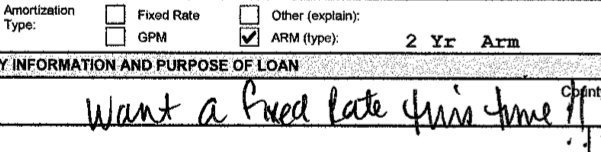

Clinic time. Let's all peep this November 4, 2009 article from our own Arthur Delaney, entitled, "This Loan Is An Example Of What Went Wrong In America".

Last December, Virginia Naill learned that the monthly

mortgage payment for her three-bedroom home on Ordinary Road in tiny

Mineral, Va., would jump by hundreds of dollars.

"I started crying," she said, "'Oh no, what did I do?'"

In 2006, it turned out, she'd unwittingly gotten herself into an adjustable-rate mortgage with a two-year teaser rate. As a result, in December, the interest rate shot up from 7.5 percent to just over 10.1

percent, and the monthly payment on her $280,000 loan went from $1,800

to more than $2,300. She and her husband didn't know how they were

going to pay it.

Naill, 50, thought she'd refinanced into a fixed-rate mortgage. Back in 2006, that's what she'd told the broker she wanted.

But she signed the documents that were put in front of her, and what she got was a case study in irresponsible lending -- a debt trap that even the broker has admitted was based on a fraudulent application.

Emphasis mine, because, puh-leez -- the predators will attest to the predation, when you finally drag the truth out of them.

Barry Ritholtz, who originally flagged this CNBC segment over at The Big Picture, comments: "It's a contest to demonstrate who knows the least about lending and legal fraud." Too right! At one point, Kudlow yammers that, "As far as

I know, there's a government resolution authority -- A GOVERNMENT

RESOLUTION AUTHORITY -- funded by four trillion dollars in the House

bill." He just doesn't know what he is talking about!

During floor debate in December, Rep. Jerry Moran (R-Kan.) railed against a "a permanent, TARP-like bailout authority." Rep. Ed Royce (R-Calif.) said, "For the first time in history, Congress is

authorizing perpetual bailout authority." Said Rep. Shelley Moore

Capito (R-W.Va.), "Rather than ending the bailouts, this legislation

institutionalizes them." And so on.

But it's just not true. The bill does set up a large fund, but the money is to be used to take big banks apart if necessary, not keep them propped up.

The bill gives the Federal Deposit Insurance Corporation new authority to dismantle failed financial institutions that pose a systemic risk to the rest of the system, a process that would be paid

for with a $150 billion "dissolution fund." The money would come from

fees paid by those companies that are so large that their uncontrolled

failure could tank the economy. The bill requires any taxpayer money to

be paid back to the Treasury before creditors see a dime. It requires

unsecured creditors to take a loss, and the FDIC is required to ensure

board members and management "responsible for the failed condition of

the covered financial company [are] removed."

The bill does allow the dissolution fund to borrow up to $150 billion from the Treasury, and more if it can get congressional approval. So taxpayer money could be used -- but to wind down a failed

institution, not bail it out.

The "$4 trillion" Kudlow is referring to is the cap on lending by the Federal Reserve in the event of a "liquidity crisis." That's a big number, to be sure, and it's perfectly fair to fear that it's setting

up another "Too Big To Fail" bailout. However, FUN FACT: the Fed has never had a cap on this sort of lending before.

We need some education! And, hey, if you watch the video, you'll catch Rick Santelli suggesting that people should be forced to take financial literacy classes! This lot would be prime candidates for such

a program, obviously. Still, I'm curious as to how these financial

literacy classes will be paid for and implemented (as Chittum remarks,

Santelli's solution is "odd for an Ayn Rand fan").

Know what, though? This is all beside the point -- the entire lending industry is based on exploiting financial illiteracy to maximize profits. And, as Delaney's example shows, when a little bit of

financial literacy enters the discussion, the lenders lie, cheat, deceive, obfuscate, inveigle, and swindle.

Tags:

Replies to This Discussion

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

FB_IMG_1770501160448

Something is Making Fishermen Disappear It’s not Alligators or Sharks

Always Wondering

how to doanload mp3 online?

Another incredibly Stupid!! What, no mirrors?

Another incredibly Stupid!! What, no mirrors?

© 2026 Created by truth.

Powered by

![]()