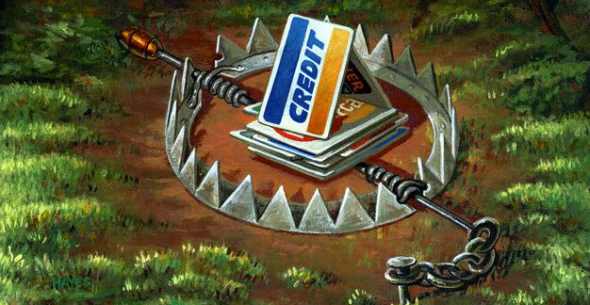

11 Things That Can Happen When You Allow Your Country To Become Enslaved To The Bankers

11 Things That Can Happen When You Allow Your Country To Become Ens...

Michael Snyder

The Economic Collapse

Aug 10, 2012

Why are Greece, Spain, Italy, Portugal and so many other countries experiencing depression-like conditions right now?

It is because they have too much debt. Why do they have too much debt? It is because they allowed themselves to become enslaved to the bankers. Borrowing money from the bankers can allow a nation to have a higher standard of living in the short-term, but it always results in a lower standard of living in the long-term. Why is that? It is because you always have to pay back more money than you borrowed. And when you get to the point of having a debt to GDP ratio in excess of 100%, you are basically drowning in debt. Huge amounts of money that could be going to providing essential services and stimulating your economy are now going to service your horrific debt. Today, citizens in Greece, Spain, Portugal and Italy are experiencing a standard of living far below what they should be because the bankers have trapped them in endless debt spirals. Sadly, the vast majority of the people living in those countries have absolutely no idea what is at the root cause of their problems.

The truth is that no sovereign nation on earth ever has to borrow a single penny from anyone.

In theory, there is nothing stopping a government from printing up debt-free money and spending it into circulation.

But that is not the way our world works.

Instead, our national governments borrow money that has been zapped into existence out of thin air by central banks.

Now what kind of sense does that make?

Why don’t our governments just create the money themselves?

If the government of Greece had been directly issuing debt-free Greek currency all these years, they would have a national debt of zero and they would not be in the middle of a deep depression today.

So why isn’t anyone proposing that they go to such a system?

Instead, everyone is trying to figure out a way that the Greeks can muddle through this depression and keep paying on their unsustainable debts.

It is such a tragedy what has happened to Greece. The city of Boston has a larger economythan the entire nation of Greece at this point.

But this is what happens when you allow the bankers to trap your country in debt. The central banking systems of the world are designed to be endless debt spirals that systematically transfer wealth from the people through the governments and into the hands of the ultra-wealthy.

Just look at what is happening in the United States. The U.S. national debt is now more than 5000 times largerthan it was when the Federal Reserve was first created.

Greece, Spain, Italy, Portugal and the rest of the nations of the western world did not get into all this debt by accident.

This happened by design.

And we can see what happens when the system starts to unravel by looking at what is happening in Greece and in Spain right now.

The following are 11 things that can happen when you allow your country to become enslaved to the bankers….

#1 At some point nations that are drowning in debt must implement “austerity measures” in an attempt to stay solvent.

This causes economic slowdown and unemployment skyrockets. We are seeing this happen in Greece, Spain and a whole bunch of other nations right now.

Over the past four years, the Greek economy has contracted by close to 25 percent. Just this week it was announced that the unemployment rate in Greece has risen to 23.1 percent.

A year ago it was just 16.8 percent

In Spain, the unemployment rate is even higher. It has hit 24.6 percent, and some analysts expect it to eventually reach 30 percent.

This would have never happened if these nations had not gotten into so much debt.

#2 Economic progress can actually go backwards in a debt-based system.

In Greece, a very large number of citizens have actually been giving up their cars and have gone back to riding bikes….

The high cost of road tax, fuel and repairs is forcing Greeks to ditch their cars in huge numbers. According to the government’s statistics office, the number of cars on Greek roads declined by more than 40 percent in each of the last two years. Meanwhile, more than 200,000 bikes were sold in 2011, up about a quarter from the previous year.

#3 Your banking system will inevitably melt down at some point.

Every debt bubble eventually bursts, and authorities all over Europe are desperately trying to keep the European banking system from completely imploding.

But despite their efforts, people are pulling money out of banks in southern Europe at a staggering pace. Just check out the slow motion bank run that is unfolding in Spain….

Capital outflows from Spain more than quadrupled in May to €41.3 billion ($50.7 billion) compared with May 2011, according to figures released on Tuesday by the Spanish central bank.

In the first five months of 2012, a total of €163 billion left the country, the figures indicate. During the same period a year earlier, Spain recorded a net inflow of €14.6 billion.

More Here http://www.infowars.com/11-things-that-can-happen-when-you-allow-yo...

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

Reality Is now Becoming Unhinged

Ghislaine Maxwell & The Secret "Shadow" 9/11 Commission? | John Kiriakou

Ghislaine Maxwell & The Secret "Shadow" 9/11 Commission? | John Kiriakou

When the Communists Take Over America!...Famous 1957 Anti-Communist Movie

When the Communists Take Over America!...Famous 1957 Anti-Communist Movie

Are the End Times Drawing Near?

Catherine Fitts: Epstein, CIA Black Budget, the Control Grid, and the Banks’ Role in War

© 2026 Created by truth.

Powered by

![]()

You need to be a member of 12160 Social Network to add comments!

Join 12160 Social Network