BANK OF JAPAN JOINS FED AND ECB IN PREPARING ROLLOUT OF DIGITAL CURRENCY

SOURCE: ZEROHEDGE

First it was the Fed, then the ECB, and now the BOJ: the world's central banks are quietly preparing to unleash digital currencies on an unsuspecting population in one final last-ditch attempt to spark inflation and do away with the current monetary orthodoxy which has failed to push living conditions for the masses higher (but most importantly, has failed to inflate away a growing mountain of insurmountable global debt).

On Friday, the Bank of Japan joined the Fed and ECB when it said it would begin experimentingon how to operate its own digital currency, rather than confining itself to conceptual research as it has to date.

Digitalization has advanced in various areas at home and abroad on the back of rapid development of information communication technology. There is a possibility of a surge in public demand for central bank digital currency (CBDC) going forward, considering the rapid development of technological innovation. While the Bank of Japan currently has no plan to issue CBDC, from the viewpoint of ensuring the stability and efficiency of the overall payment and settlement systems, the Bank considers it important to prepare thoroughly to respond to changes in circumstances in an appropriate manner.

The bank explained that it might provide general purpose CBDC if cash in circulation drops "significantly" and private digital money is not sufficient to substitute the functions of cash, while promising to supply physical cash as long as there is public demand for it

The move, as Reuters reports, came in tandem with an announcement by a group of seven major central banks, including the BOJ, on what they see as core features of a central bank digital currency (CBDC) such as resilience and a clear legal framework. It also falls in line with new Japanese Prime Minister Yoshihide Suga’s focus on promoting digitalization and administrative reform to boost the country’s competitiveness.

In a report laying out its approach on CBDC, the BOJ said it will conduct a first phase of experiments on basic functions core to CBDCs, such as issuance and distribution, early in the fiscal year beginning in April 2021. The experiments will be part of the BOJ’s efforts to look more closely into how it can issue general-purpose CBDCs, intended to be used widely among the general public including companies and households.

Naturally, to avoid sparking a panic that paper money is on its way out - and thus prompt the population to hoard it - the BOJ said that CBDCs "will complement, not replace, cash and focus on making payment and settlement systems more convenient." However, how exactly it is "more convenient" for the central bank to be able to remotely extinguish any amount of money in one's digital wallet without notice, remains a mystery.

Unlike the Fed, the BOJ plans to have financial institutions and other private entities serve as intermediaries between the central bank and end users, rather than have companies and households hold deposits directly with the BOJ.

“While the BOJ currently has no plan to issue CBDC ... it’s important to prepare thoroughly to respond to changes in circumstances,” the report said.

In the second phase of experiments, the BOJ will look at the potential design of CBDCs such as whether it should set a limit on the amount issued and pay a remuneration on deposits.

In the final step before issuance, the BOJ will launch a pilot program involving private firms and households, it said.

The BOJ added it would be desirable for the CBDC to be used not only for domestic but cross-border payments, in short don't worry, this is just an experiment... but once operational it will take over the entire existing monetary system.

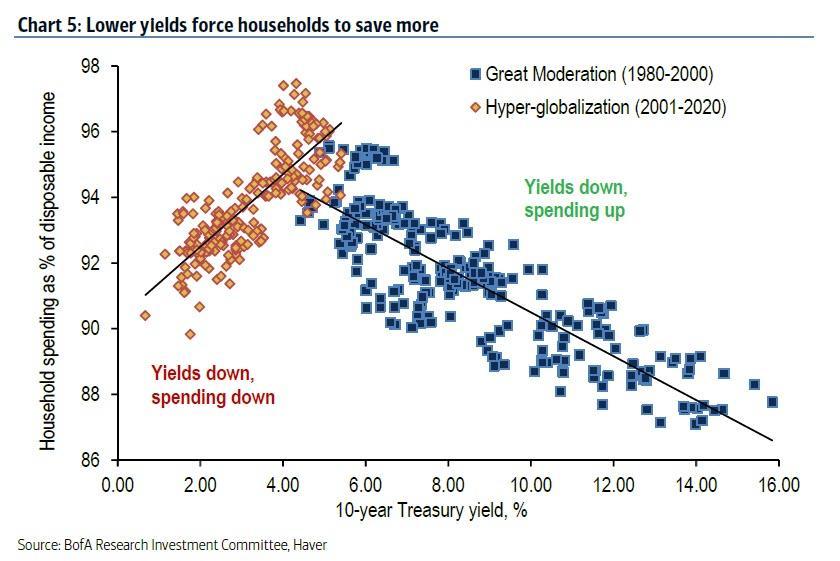

To be sure, having complete control over the entire monetary transmission mechanism, all the way to each quantum of currency in circulation has been a central banker dream. A key reasons for negative rates was for banks to force consumers to pull their money out of the bank and spend it, thus lifting the velocity of money. Alas, as we showed previously, the lowest interest rates in history merely prompted even more savings and less spending, resulting in catastrophic consequences for the financial sectors wherever negative rates were adopted, such as Japan and Europe.

Until now, Japan had been cautious about moving too quickly on digital currencies given the social disruptions it could cause in a country that has the world’s most cash-loving population. But China’s steady progress toward issuing digital currency has prompted the government to reconsider, especially if China takes the lead in sparking a new reflationary tide once it converts its entire population to digital currency, and pledged in this year’s policy platform to look more closely at the idea.

Of course, the real reason behind central bank urgency to implement digital currencies is simple and has nothing to do with serving the population, increasing facility of transfers, or enhancing stability and efficiency of payment and settlement systems. It has everything to do with having discrete control over inflation, and enabling worldwide "helicopter money." This is how DoubleLine fixed income portolio manager Bill Campbell described it in his latest must-read note "The Pandora's Box of Central Bank Digital Currencies."

With QE, central banks have printed excess reserves that have benefited only the very wealthy and large institutions. The innovation of a digital currency system as described by Mastercard could deliver stimulus directly to consumers. Such a mechanism could open veritable floodgates of liquidity into the consumer economy and accelerate the rate of inflation. While central banks have been trying without success to increase inflation for the past decade, the temptation to put CBDCs into effect might be very strong among policymakers. However, CBDCs would not only inject liquidity into the economy but also could accelerate the velocity of money. That one-two punch could bring about far more inflation than central bankers bargain for.

When first implementing QE, central banks promised that this measure would be temporary and would be unwound after the crisis ended, a pledge that I have doubted for a while. Central banks as we know have perpetuated QE as part of their updated toolbox of monetary policies. The first use of digital currencies in monetary policy might start small as policymakers, out of caution, seek to calibrate this experiment in quasi-fiscal stimulus. However, such initial restraint could give way to growing complacency and greater use of the tool – just as we saw with QE. The temptations of CBDCs are not limited to excesses in monetary policy. CBDCs also appear to be an effective mechanism for bypassing the taxation, debt issuance and spending prerogatives of government to implement a quasi-fiscal policy. Imagine, for example, the ease of enacting Modern Monetary Theory via CBDCs. With CBDCs, the central banks would possess the necessary plumbing to directly deliver a digital currency to individuals’ bank accounts, ready to be spent via debit cards.

Let me quote again from Charles I. Plosser’s warning in 2012: “Once a central bank ventures into fiscal policy, it is likely to find itself under increasing pressure from the private sector, financial markets, or the government to use its balance sheet to substitute for other fiscal decisions.” With a flick of the digital switch, CBDCs can enable policymakers to meet, or cave in to, those demands – at the risk of igniting an inflation conflagration, abandoning what little still survives of sovereign fiscal discipline and who knows what else. I hope the leaders of the world’s central banks will approach this new financial technology with extreme caution, guarding against its overuse or outright abuse. It’s hard to be optimistic. Soon our monetary Pandoras will possess their own box full of new powers, perhaps too enticing to resist.

Here is another reason why it is hard to be optimistic: without virtually any public discourse or debate, central banks are now so far down along in the process that they are just steps away from rolling out a private-sector venture with one of the largest digital payments processors in the world. Below is a press releasethat virtually nobody noticed in early September from none other than electronic payment giant MasterCard, in which it revealed that it had launched "Central Bank Digital Currencies (CBDCs) Testing Platform, Enabling ..."

With the global economy racing to embrace digital payments, central banks also are looking to the future and investigating how to support innovation while maintaining monetary policy and financial stability as they issue and distribute currency. In fact, 80 percent of central banks surveyed are engaging in some form of Central Bank Digital Currencies (CBDCs) work, and about 40 percent of central banks have progressed from conceptual research to experimenting with concept and design, according to a recent survey by the Bank for International Settlements.

Today, Mastercard announced a proprietary virtual testing environment for central banks to evaluate CBDC use cases. The platform enables the simulation of issuance, distribution and exchange of CBDCs between banks, financial service providers and consumers. Central banks, commercial banks, and tech and advisory firms are invited to partner with Mastercard to assess CBDC tech designs, validate use cases and evaluate interoperability with existing payment rails available for consumers and businesses today.

Mastercard is a leader in operating multiple payment rails and convening partners to ensure a level playing field for everyone – from banks to businesses to mobile network operators – in order to bring the most people possible into the digital economy. Mastercard wants to harness its expertise to enable the practical, safe and secure development of digital currencies.

“Central banks have accelerated their exploration of digital currencies with a variety of objectives, from fostering financial inclusion to modernizing the payments ecosystem," said Raj Dhamodharan, Executive Vice President, Digital Asset and Blockchain Products and Partnerships, Mastercard. “Mastercard is driving innovation with the public sector, banks, fintechs, and advisory firms in the exploration of CBDCs, working with partners that are aligned to our core values and principles. This new platform supports central banks as they make decisions now and in the future about the path forward for local and regional economies,” Dhamodharan added.

Sheila Warren, Head of Blockchain, Digital Assets and Data Policy at the World Economic Forum, said: “Collaborations between the public and private sectors in the exploration of Central Bank Digital Currencies can help central banks better understand the range of technology possibilities and capabilities available with respect to CBDCs. Central banks can benefit from support in exploring the option set available to them with respect to CBDCs, as well as gaining insight into what opportunities may be forthcoming.”

Finally, why are central banks using blockchain as the backbone for all digital currency efforts? It has nothing to do with their fascination with bitcoin, or their fear that cryptocurrencies can become dominant (although there certainly is an element of that). The real reason is that blockchain allows every single discrete currency unit, whether it is the digital dollar, digital euro, digital yen or digital yuan, to be tracked from its digital inception, through every single transaction, and to which wallet it can be found in at any given moment. In short, blockchain-based digital currencies will allow central banks to have a real-time map of absolutely every monetary unit in circulation, and every single economic transaction, something they can't do with trillions in anonymous paper money still sloshing around (the inverse process was launched by the ECB when it did away with the notorious€500 banknote which allowed European to easily circumvent Europe's negative interest rates). And, of course, when push comes to shove, central banks will also be able to "warn" the public the digital money in their digital wallets may soon expire, sparking an inflationary flood of spending with the flick of a switch.

SHARE THIS ARTICLE...

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

Our Crazy Modern World

2DF36465-A826-443C-A3A8-6638BC1D4FFA

G_LrzqtXMAAhT7w

2DF36465-A826-443C-A3A8-6638BC1D4FFA

2DF36465-A826-443C-A3A8-6638BC1D4FFA

Jacob Collier Improvises With Orchestra (Live in San Francisco)

Архітектура для мегаполісів: виклики та рішення урбаністики

© 2026 Created by truth.

Powered by

![]()

You need to be a member of 12160 Social Network to add comments!

Join 12160 Social Network