Empty your pension accounts - Detroit bankruptcy provokes calls for nationwide assault on pensions by the parasites

Government representatives of a number of major American cities have seized on Detroit’s bankruptcy filing last month to raise calls for an intensified attack on public worker pensions and benefits. The wave of comments have come in the weeks following Detroit Emergency Manager Kevyn Orr’s announcement that he will seek to cut the pensions of Detroit city workers and retirees.

The most aggressive statements were made by billionaire New York City mayor Michael Bloomberg, who said in a speech Tuesday that Detroit is “the road to ruin for any American city. I believe that the Detroit experience holds lessons for every American city—and that we have an obligation to protect our future by examining those lessons.”

Bloomberg then laid the blame for the Detroit bankruptcy at the feet of workers and retirees:

“One of the major reasons that Detroit could not stop its downward spiral was that its labor costs—especially its retiree costs for pensions and health care—crowded out its ability to invest in the things that make a city an attractive place to live and visit.”

Bloomberg’s speech culminated in a blunt threat to workers and retirees in America’s most populated city. “We are only a short distance from relapsing into decline if we allow health care and pension benefits to crowd out the investments that make New York City a place where people want to live, work, study, and visit,” he said.

Bloomberg’s comments were echoed by the mayor of Chicago, the third most populated city in the US. Rahm Emanuel, a Democrat who served as chief of staff to President Obama from 2009 to 2010, told the New York Times on August 5 that “this is kind of the dark cloud that’s coming ever closer,” and that “what the system needs is a hard, cold dose of honesty.”

In the article, the Times wrote that “as Detroit makes its way through the federal court system, other cities, including Chicago, are wrestling with overwhelming pension liabilities that threaten to undermine their capacity to provide municipal services and secure their futures.”

Democrat Eric Garcetti, the mayor of the second largest city in the US, Los Angeles, also promised deep cuts to pensions.

“It’s going to be very important to me that we hold down those raises [for city workers], pensions and health care plans that in the past have driven expenses in this city… I will continue to do that at the negotiating table as mayor,” he said in the aftermath of the Detroit declaration of bankruptcy.

Philadelphia, the fifth-largest city in the US, has already cut benefits for new city workers, according to Mark McDonald, a spokesman for Democratic Mayor Michael Nutter. Additionally, Democrat Greg Stanton, the mayor of Phoenix, Arizona, told Bloomberg News last week that a recent decision to raise worker contributions toward retirement benefits “will put us in a significantly better position. Phoenix is not Detroit.”

Threats of deeper cuts to pensions are not limited to those cities listed above. Funds in New Orleans, Louisiana; Charleston, West Virginia; Omaha, Nebraska; Houston, Texas; San Jose, California and a host of other major cities have recently been slated for significant cuts.

The matching responses of the most powerful mayors in America illustrate the fact that the bankruptcy of Detroit is being used as a test case for a nationwide scheme to strip current and former workers of their contractually guaranteed pensions and benefits. Beneath the relentless pressure of Wall Street creditors, scores of American cities are employing the threat of the “dark cloud” of Detroit to implement a massive transfer of wealth out of the pension funds and into the speculative markets.

This effort has already shaken some municipal bond markets in a manner that threatens to drive cities even further into debt. Following the Detroit bankruptcy, three Michigan localities have delayed sales of general-obligation bonds, fearing that concerns over the Detroit bankruptcy may drive interest rates higher and force cities and counties to fork over larger sums to creditors.

To continue reading:http://rinf.com/alt-news/breaking-news/detroit-bankruptcy-provokes-...

Comment

-

Comment by Wolf on August 13, 2013 at 10:12am

-

That seems to be the long and the short of everything.

In the video I posted by Corbett it is said quite well (and I paraphrase) they have had 100 years to enact their plans. The only thing to stop them is fear.

It seems that most Americans are too busy trying to survive or are stirring the pot. If thinking, rational people with any type of brain activity would just stop playing the game then we win. But sadly, there are people, even on 12160 who are using the hate card not realizing (I hope) that they are serving the mission against the people of this planet.

I think it is telling that the technology is used against us, not to catch the ultra rich thieves, as always used against the people, at their own expense. What more do we need to know?

-

Comment by Dave Phillips on August 13, 2013 at 8:02am

-

Why at the bottom of every financial fuck up is the tax paying worker the problem? Why should a man or woman who worked 30 or 40 or more years have to give up any of the quality of life benefits his or her pension provides for? If I went to a bank and said sorry your money is now mine because I need it to prop up a failing business I would get laughed at then escorted to the hospital for assessment and probably arrested for something they make up. But when the city and banks and pension funds turn around and say sorry Joe your money is needed for this failing bank and that is more important than you being able to fly to see friends or family across the country so we will cut your benefits so you can eat and that's about it, we will take the rest and waste it on some scheme to enrich the already filthy rich. What a cluster fuck!

-

Comment by Wolf on August 12, 2013 at 2:58pm

-

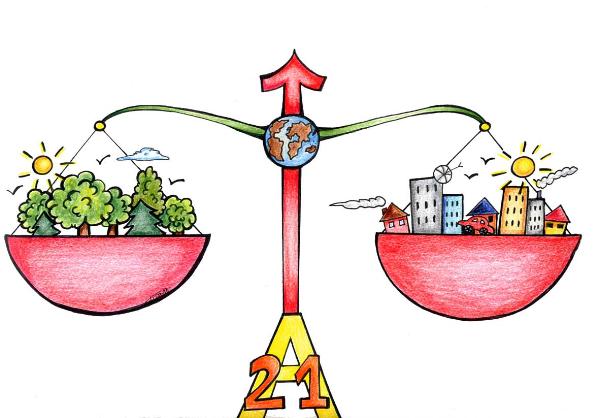

You have some great clip art...:)

-

Comment by suzie on August 12, 2013 at 11:00am

-

-

Comment by suzie on August 12, 2013 at 10:58am

-

-

Comment by Wolf on August 12, 2013 at 10:13am

-

"the bankruptcy of Detroit is being used as a test case for a nationwide scheme to strip current and former workers of their contractually guaranteed pensions and benefits..the threat of the “dark cloud” of Detroit to implement a massive transfer of wealth out of the pension funds and into the speculative markets."

These clusters of "people" are self serving, they have no problem raping and pillaging anyone to get their grubby hands on every penny they can. They are the true parasites...by definition and example. NWO is coming for your hard earned pensions. Threats of deeper cuts in pension funds in New Orleans, Louisiana; Charleston, West Virginia; Omaha, Nebraska; Houston, Texas; San Jose, California and a host of other major cities have recently been slated for significant cuts." PARASITES.

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

Ghislaine Maxwell & The Secret "Shadow" 9/11 Commission? | John Kiriakou

When the Communists Take Over America!...Famous 1957 Anti-Communist Movie

When the Communists Take Over America!...Famous 1957 Anti-Communist Movie

Are the End Times Drawing Near?

Catherine Fitts: Epstein, CIA Black Budget, the Control Grid, and the Banks’ Role in War

Ключові слова в тексті: як органічно їх вписати в статтю

© 2026 Created by truth.

Powered by

![]()

You need to be a member of 12160 Social Network to add comments!

Join 12160 Social Network