Wall Street billionaire Pete Peterson is scheming to "Fix the Debt,"

but if he wins, we lose.

George Soros! Pete Peterson is "the most influential billionaire in America," says the LA Times.

Peter G. Peterson has long used his wealth to underwrite numerous organizations and PR campaigns to generate public support for slashingSocial Security and Medicare, citing concerns over "unsustainable" federal budget deficits. Full of apocalyptic warnings, Peterson failed to warn of the $8 trillion housing bubble, but conveniently sold his private equity firm Blackstone Group on the eve of the financial crisis. He later pledged to spend $1 billion of the money from the sale to "fix America's key fiscal-sustainability problems," launching the Peter G. Peterson Foundation in 2008.[2] As of 2011, the Huffington Post reported that Peterson had personally given $458 million to the Foundation.[3]

Peterson told the Washington Post that he gave Fix the Debt $5 million in funding;[4] Fix the Debt was announced on the Peterson Foundation website[5] and Peterson appeared at the Fix the Debt launch in July 2012.[6] Peterson also funds Fix the Debt parent organization Committee for a Responsible Federal Budget at theNew America Foundation. Even before the 2012 Campaign to Fix the Debt, Peterson poured millions into a multifaceted effort to support the Simpson-Bowles Commission and its $4 trillion austerity package, a plan that would cost the nation four million jobs, according to the Economic Policy Institute,[7] and "destroy Social Security as we know it," according to Social Security Works.[8] He bankrolled nineteen "America Speaks" Town Hall meetings, which spectacularly backfired, launched the "OweNo" TV ad campaign, and funded the Concord Coalition’s Fiscal Solutions tour to take the message to the heartland. When the commission blew up -- failing to get the votes needed to advance a plan to Congress -- Peterson gave Bowles and Simpson a new perch at the Committee for a Responsible Federal Budget to allow them to continue to scold Congress. Learn more about Pete Peterson in "Peterson's Long History of Deficit Scaremongering" in The Nation.

Key Findings & Useful Charts

Astroturf Supergroup

With 127 CEOs able to schedule meetings with President Obama and Congressional leaders, numerous PR firms lending a hand,[9] 80 staff,[10] multiple Peterson funded "partner" groups, and 23 phony state chapters, this incarnation of the Peterson message machine must be taken seriously. Fix the Debt documents say the group is targeting a budget of $60 million for the "first phase," [11] but in February 2013 Fix the Debt's spokesperson told CMD the organization had only raised $40 million so far. Fix the Debt engaged in a multi-million dollar paid ad campaign in the run-up to the so-called "fiscal cliff" and now is taking that campaign outside the beltway, which is "increasingly resembling a presidential race with grassroots style organizing and offices in places like New Hampshire and Ohio," writes Fortune magazine.[10] As of February 2013, group was touting it 345,000 members/petition signatures. That sounds impressive until one learns that a number of CEOs, such as the CEO of Caterpillar Inc., wrote to 130,000 employees encouraging them to sign [12]and one recalls that their goal was 10 million.[13]Learn more about the firms and the stunts behind the PR spin in the article "Pete Peterson's Puppet Populists" and the Fix the Debt Partners page.

Undisclosed Conflicts of Interest

Fix the Debt biographies fail to reveal that their core leadership team is riddled with conflicts of interest. Public Accountability Initiative (PAI) points to at least 13 steering committee members with financial ties to firms that lobby on deficit-related matters that are not disclosed in their glossy Fix the Debt bios. These firms lobby to preserve dozens of costly tax breaks (including the “carried interest” tax loophole that made Pete Peterson a rich man) or to hold off new taxes, such as the “Robin Hood Tax,” a proposed financial speculation tax that could raise as much as a $1 trillion over 10 years.[14] Click here to see a chart of these conflicts of interest and tax lo...

Prominent CEOs Fail to Fully Fund Employee Pension Plans

While Fix the Debt’s 127 CEOs call for cuts to Social Security (a program that does not contribute to the deficit since it is has a surplus and is accounted for outside the federal budget), many of the publicly-traded Fix the Debt firms underfund their employee pension plans by some $103 billion making their employees even more dependent on Social Security.[15] The CEOs, of course, enjoy lavish retirement packages, averaging $9 million each, according to a study by the Institute for Policy Studies.[16] Click here to see a chart of CEO retirement assets vs. underfunded ...

The Real Corporate Tax Loophole Agenda

Many Fix the Debt firms pay a negative tax rate, which contributes greatly to the federal deficit. Worse, Fix the Debt firms are pushing for a "globally competitive"territorial tax system that would increase the debt by $1 trillion over ten years and encourage the offshoring of U.S. jobs, according to Citizens for Tax Justice.[14] This tax cut is not listed in their online goals and rarely spoken of explicitly, but it is mentioned on a slideshow buried on the group's website. The switch would not only add to the deficit, it results in a windfall of some $134 billion dollars for at least 63 Fix the Debt firms, including Google and GE, according to a report by the Institute for Policy Studies.[17] Click here to see a table of 10 top winners from a territorial tax ...

Many of the Firms Are Federal Defense Contractors

While Fix the Debt targets government programs for the middle class, 38 Fix the Debt leaders are tied to companies with defense contracts totaling $43.4 billion in 2012, as PAI has documented.[18] Boeing (with $25.1 billion in defense contracts) and Northrop Grumman (with $8.5 billion) lead the pack. Boeing CEO W. James McNerney, Jr. is on Fix the Debt’s CEO Council, and Northrop Grumman board member Vic Fazio is on Fix the Debt’s steering committee. Click here to see a chart of the top six defense contractors with F...

Fix the Debt Leaders & Conflicts of Interest

Fix the Debt biographies consistently fail to expose the financial and lobbying ties of Fix the Debt leaders. You can see a chart of undisclosed financial interests by clicking here or visit our Fix the Debt Leaders page for more detail.

Erskine Bowles

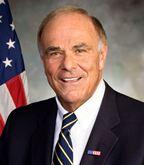

Erskine Bowles, a Fix the Debt co-founder[19] and board member of Fix the Debt's parent organization, the Peterson-funded CRFB,[20] is best known for his co-chairmanship of the Simpson-Bowles Commission and for being Bill Clinton's chief of staff. Yet he has deep ties to the financial industry, which has lobbied heavily on tax issues.[21] UNDISCLOSED CONFLICT OF INTEREST:Bowles has served on the board of Morgan Stanley since 2005[22] (with annual compensation of $345,000 in 2011).[23][24] Morgan Stanley played a major role in the 2008 financial crisis and secretly borrowed over $107 billion from the Federal Reserve according to Bloomberg News.[25] His wife, Crandall C. Bowles, is on the executive committee of the board of directors of JP Morgan Chase[26] (with annual compensation of $245,000 in 2011).[27]Ed Rendell

Ed Rendell is a co-chairman of Fix the Debt.[19] In media appearances, he is only introduced as the former Democratic governor of Pennsylvania (2003-2011), yet he has extensive corporate and financial ties.UNDISCLOSED CONFLICT OF INTEREST: Rendell lobbied for KCI USA, a wound care technology company, on Medicare and Medicaid reimbursements in 2012.[28]Rendell is special counsel to the law firm Ballard Spahr[29] -- which has been criticized as a union-busting law firm--[30] -- where he focuses on privatization and housing, with an emphasis on infrastructure.[31] Rendell is also a senior adviser at Greenhill & Co., a multinational investment bank. Ninety percent of Greenhill's revenue comes from advisory assignments,[32] including to public officials. Rendell is a strong proponent of "public private partnerships" (PPPs) in infrastructure, which have been criticized as a dubious form of privatization of public assets.[33] Rendell is also on the advisory board of Verdeva, a firm developing technology to track motorists at the gas pump so they can be taxed for infrastructure revenue, an industry-favored measure for developing the income streams they need to finance infrastructure deals.[34] He has also joined the venture capital firm Element Partners as an operating partner.[35] Element Partners recently invested in oil and gas extraction (fracking) from the Marcellus formation.[36]Maya MacGuineas

Maya MacGuineas spearheads the Fix the Debtcampaign. She is the president of Fix the Debt's parent organization, the Committee for a Responsible Federal Budget, which is a project of the Peterson-funded New America Foundation (NAF). MacGuineas was dubbed "queen of the deficit scolds" by economist Paul Krugman[37] Although it is not disclosed on her Fix the Debt bio, she has long advocated for the privatization of Social Security (see 2001 testimony.)[38]UNDISCLOSED CONFLICT OF INTEREST:MacGuineas' husband Robin Brooks is a managing director and a currency trading analyst at Goldman Sachs.[39] Goldman Sachs lobbies around federal tax issues affecting banking and securities and is a member of the Managed Funds Association, which lobbies against efforts to make Wall Street pay its fair share such as the proposed "Robin Hood Tax," a a tiny tax on trades that some economists project could raise $1 trillion over 10 years.[40][41]Peterson-Funded Fix the Debt Partner Groups

Pete Peterson has given at least $5 million to Fix the Debt, according to theWashington Post.[42] Fix the Debt is listed as a project of the Committee for a Responsible Federal Budget (CRFB) on CRFB's website. Peterson has long funded CRFB and served on its board.[43] CRFB is itself a project of the New America Foundation (NAF). In the 1990s, CRFB partnered with tobacco firms, anxious to avoid higher excise taxes on cigarettes, to tank the Clinton health care plan.[44]Today, critics claim CRFB is a "Trojan Horse" for a similar agenda to cut taxes for wealthy corporations who want to create a territorial tax system.[45]

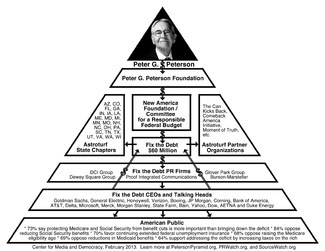

The Peter G. Peterson Foundation funds at least six of the "partner" organizations listed on Fix the Debt's website:

- Committee for a Responsible Federal Budget/New America Foundation: $2,050,000,[46]

- The Moment of Truth Project: $300,000 (another project of CRFB),[46]

- Comeback America Initiative: $3,100,000,[47]

- Committee for Economic Development: $1,853,616,[48] and

- Concord Coalition: $6,036,060 (including $1,500,000 in matching funds).[49]

With regard to Fix the Debt and its many partner organizations, the National Journalobserved: "Singlehandedly, Peterson has created a loose network of deficit hawk organizations that seem independent but that all spout the Peterson-sanctioned message of a 'grand bargain.'"[50]

Fix the Debt Phony State Chapters & Lobbyist Leaders

More than 90 Fix the Debt leaders at the state level are current or former lobbyists, and many lobby for Fix the Debt firms, according to a review of federal and state lobbying databases by the Center for Media and Democracy in February 2013. Click here to see a list of state leaders and their lobbying ties.

Featured Articles

- PRWatch.org, Pete Peterson’s “Fix the Debt” Astroturf Supergroup Detailed in New..., February 21, 2013.

- Lisa Graves, Pete Peterson's Long History of Deficit Scaremongering, The Nation, February 21, 2013.

- John Nichols, The Austerity Agenda: An Electoral Loser, The Nation, February 21, 2013.

- Dean Baker, Fix the Debt's Fuzzy Math, The Nation, February 21, 2013.

- Mary Bottari, Pete Peterson's Puppet Populists, The Nation, February 21, 2013.

- The Nation Editorial Board,Stacking the Deck: The Phony 'Fix the Debt' Campaign, The Nation, February 21, 2013.

- Fix the Debt's Leadership

- Fix the Debt Leaders' Conflicts of Interest

- Fix the Debt's Partner Groups

- Fix the Debt's State Chapters

- Fix the Debt's Lobbyists

- Fix the Debt's Parent Group

- Fix the Debt's Corporations

- Pete Peterson

- Peter G. Peterson Foundation

- Social Security

- Medicare

Press on Fix the Debt

- Huffington Post, Robert Borosage,Will Half a Billion Bucks Buy a New Recession?, February 21, 2013.

- Washington Post, Ezra Klein, The Problem with Alan Simpson, "Wonkblog," February 20, 2013.

The Pyramid Scheme

Wall Street Welcomes Fix the Debt

The Can Kicks Back

Fix the Debt Firms: Unpaid Taxes and Underfunded Pensions

Fix the Debt CEOs say they are worried about the debt and deficits, yet many Fix the Debt firms pay a negative tax rate or a tax rate well below the standard 35 percent -- adding greatly to our nation’s deficit. Fix the Debt CEOs say that what is needed to balance the books is cuts to earned benefit programs like Social Security (which is a separate federal program not counted in the federal budget at all). At the same time, many of these same CEOs under-fund their employee pension plans, making it likely that their workers will be even more dependent on Social Security. This hypocrisy has led to a campaign called "Flip the Debt," which calls upon major corporations to pay their fair share of taxes.

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

Ключові слова в тексті: як органічно їх вписати в статтю

Orwell - Football, Beer & Gambling

I, Pet Goat VI by - Seymour Studios | I, Pet Goat 6

Official Trailer NOVA '78 directed by Aaron Brookner and Rodrigo Areias

Peter Sellers - The Party (opening scene)

Disgraced Former CNN Anchor Don Lemon Arrested

© 2026 Created by truth.

Powered by

![]()

You need to be a member of 12160 Social Network to add comments!

Join 12160 Social Network