History of the United States dollar

The history of the dollar in North America pre-dates American independence. It began with the issuance of early American currency called the colonial scrip. Even before the Declaration of Independence, the Continental Congress had authorized the issuance of dollar denominated coins and currency, since the term 'dollar' was in common usage referring to Spanish colonial eight-real coin or Spanish dollar. Though several monetary systems were proposed for the early republic, the dollar was approved by Congress in a largely symbolic resolution on August 8, 1785. After passage of the Constitution was secured, the government turned its attention to monetary issues again in the early 1790s under the leadership of Alexander Hamilton, the secretary of the treasury at the time. Congress acted on Hamilton's recommendations in the Coinage Act of 1792, which established the dollar as the basic unit of account for the United States. The word dollar is derived from Low Saxon cognate of the High German Thaler, an abbreviation of Joachimsthaler – (coin) from Joachimsthal (St. Joachim's Valley, now Jáchymov, Bohemia, then part of the Holy Roman Empire, now part of the Czech Republic; for further history of the name, see dollar.) – so called because it was minted from 1519 onwards using silver extracted from a mine which had opened in 1516 near Joachimstal, a town in the Ore Mountains of northwestern Bohemia.

Because gold and silver in the open marketplace vary independently, the production of coins of full intrinsic worth under any ratio will nearly always result in the melting of either all silver coins or all gold coins. In the early 19th century, gold rose in relation to silver, resulting in the removal from commerce of nearly all gold coins, and their subsequent melting. Therefore, in 1834, the 15:1 ratio of silver to gold was changed to a 16:1 ratio by reducing the weight of the nation's gold coinage. This created a new U.S. dollar that was backed by 1.50 g (23.22 grains) of gold. However, the previous dollar had been represented by 1.60 g (24.75 grains) of gold. The result of this revaluation, which was the first-ever devaluation of the U.S. dollar, was that the value in gold of the dollar was reduced by 6%. Moreover, for a time, both gold and silver coins were useful in commerce.

In 1853, the weights of U.S. silver coins (except, interestingly, the dollar itself, which was rarely used) were reduced. This had the effect of placing the nation effectively (although not officially) on the gold standard. The retained weight in the dollar coin was a nod to bimetallism, although it had the effect of further driving the silver dollar coin from commerce. Foreign coins, including the Spanish dollar, were also widely used[1] as legal tender until 1857.

With the enactment of the National Banking Act of 1863, during the American Civil War and its later versions that taxed states' bonds and currency out of existence, the dollar became the sole currency of the United States and remains so today.

In 1878, the Bland-Allison Act was enacted to provide for freer coinage of silver. This act required the government to purchase between $2 million and $4 million worth of silver bullion each month at market prices and to coin it into silver dollars. This was, in effect, a subsidy for politically influential silver producers.

The discovery of large silver deposits in the Western United States in the late 19th century created a political controversy. Due to the large influx of silver, the value of silver in the nation's coinage dropped precipitously. On one side were agrarian interests such as the United States Greenback Party that wanted to retain the bimetallic standard in order to inflate the dollar, which would allow farmers to more easily repay their debts. On the other side were Eastern banking and commercial interests, who advocated sound money and a switch to the gold standard. This issue split the Democratic Party in 1896. It led to the famous "cross of gold" speech given by William Jennings Bryan, and may have inspired many of the themes in The Wizard of Oz. Despite the controversy, the status of silver was slowly diminished through a series of legislative changes from 1873 to 1900, when a gold standard was formally adopted. The gold standard survived, with several modifications, until 1971.

Gold standard

Bimetallism persisted until March 14, 1900, with the passage of the Gold Standard Act, which provided that:

- "...the dollar consisting of twenty-five and eight-tenths grains (1.67 g) of gold nine-tenths fine, as established by section thirty-five hundred and eleven of the Revised Statutes of the United States, shall be the standard unit of value, and all forms of money issued or coined by the United States shall be maintained at a parity of value with this standard..."

Thus the United States moved to a gold standard, making both gold and silver the legal-tender coinage of the United States, and guaranteed the dollar as convertible to 1.5 g (23.22 grains) of gold.[2]

The gold standard was suspended twice during World War I, once fully and then for foreign exchange. At the onset of the war, U.S. corporations had large debts payable to European entities, who began liquidating their debts in gold. With debts looming to Europe, the dollar to British pound exchange rate reached as high as $6.75, far above the (gold) parity of $4.8665. This caused large gold outflows until July 31, 1914 when the New York Stock Exchange closed and the gold standard was temporarily suspended. In order to defend the exchange value of the dollar, the US Treasury Department authorized state and nationally-charted banks to issue emergency currency under the Aldrich-Vreeland Act, and the newly-created Federal Reserve organized a fund to assure debts to foreign creditors. These efforts were largely successful, and the Aldrich-Vreeland notes were retired starting in November and the gold standard was restored when the New York Stock Exchange re-opened in December 1914.[3]

As the United States remained neutral in the war, it remained the only country to maintain its gold standard, doing so without restriction on import or export of gold from 1915-1917. During the participation of the United States as a belligerent, President Wilson banned gold export, thereby suspending the gold standard for foreign exchange. After the war, European countries slowly returned to their gold standards, though in somewhat altered form.[3][4]

During the Great Depression, every major currency abandoned the gold standard. Among the earliest, the Bank of England abandoned the gold standard in 1931 as speculators demanded gold in exchange for currency, threatening the solvency of the British monetary system. This pattern repeated throughout Europe and North America. In the United States, the Federal Reserve was forced to raise interest rates in order to protect the gold standard for the US dollar, worsening already severe domestic economic pressures. After bank runs became more pronounced in early 1933, people began to hoard gold coins as distrust for banks led to distrust for paper money, worsening deflation and depleting gold reserves.[3][4]

The Gold Reserve Act

In early 1933, in order to fight severe deflation Congress and President Roosevelt implemented a series of Acts of Congress and Executive Orders which suspended the gold standard except for foreign exchange, revoked gold as universal legal tender for debts, and banned private ownership of significant amounts of gold coin. These acts included Executive Order 6073, the Emergency Banking Act, Executive Order 6102, Executive Order 6111, the Agricultural Adjustment Act, 1933 Banking Act, House Joint Resolution 192, and later the Gold Reserve Act.[3] These actions were upheld by the U.S. Supreme Court in the "Gold Clause Cases" in 1935.[5]

For foreign exchange purposes, the set $20.67 per ounce value of the dollar was lifted, allowing the dollar to float freely in foreign exchange markets with no set value in gold. This was terminated after one year. Roosevelt attempted first to restabilize falling prices with the Agricultural Adjustment Act; however, this did not prove popular, so instead the next politically popular option was to devalue the dollar on foreign exchange markets. Under the Gold Reserve Act the value of the dollar was fixed at $35 per ounce, making the dollar more attractive for foreign buyers (and making foreign currencies more expensive for those holding dollars). This change led to more conversion of gold into dollars, allowing the U.S. to effectively corner the world gold market.[6][7]

The suspension of the gold standard was considered temporary by many in markets and in the government at the time, but restoring the standard was considered a low priority to dealing with other issues.[3][6]

Under the post-World War II Bretton Woods system, all other currencies were valued in terms of U.S. dollars and were thus indirectly linked to the gold standard. The need for the U.S. government to maintain both a $35 per troy ounce (112.53 ¢/g) market price of gold and also the conversion to foreign currencies caused economic and trade pressures. By the early 1960s, compensation for these pressures started to become too complicated to manage.

In March 1968, the effort to control the private market price of gold was abandoned. A two-tier system began. In this system all central-bank transactions in gold were insulated from the free market price. Central banks would trade gold among themselves at $35 per troy ounce (112.53 ¢/g) but would not trade with the private market. The private market could trade at the equilibrium market price and there would be no official intervention. The price immediately jumped to $43 per troy ounce (138.25 ¢/g). The price of gold touched briefly back at $35 (112.53 ¢/g) near the end of 1969 before beginning a steady price increase. This gold price increase turned steep through 1972 and hit a high that year of over $70 (2.25 $/g). By that time floating exchange rates had also begun to emerge, which indicated the de facto dissolution of the Bretton Woods system. The two-tier system was abandoned in November 1973. By then the price of gold had reached $100 per troy ounce (3.22 $/g).

In the early 1970s, inflation caused by rising prices for imported commodities, especially oil, and spending on the Vietnam War, which was not counteracted by cuts in other government expenditures, combined with a trade deficit to create a situation in which the dollar was worth less than the gold used to back it.

In 1971, President Richard Nixon unilaterally ordered the cancellation of the direct convertibility of the United States dollar to gold. This act was known as the Nixon Shock.

U.S. dollar value vs. gold value

The sudden jump in the price of gold after the demise of the Bretton Woods accords was a result of the significant prior debasement of the US dollar due to excessive inflation of the monetary supply via central bank (Federal Reserve) coordinated fractional reserve banking under the Bretton Woods partial gold standard. In the absence of an international mechanism tying the dollar to gold via fixed exchange rates, the dollar became a pure fiat currency and as such fell to its free market exchange price versus gold. Consequently, the price of gold rose from $35 per troy ounce (1.125 $/g) in 1969 to almost $500 (29 $/g) in 1980.

Shortly after the gold price started its ascent in the early 1970s, the price of other commodities such as oil also began to rise. While commodity prices became more volatile, the average exchange rate between oil and gold remained much the same in the 1990s as it had been in the 1960s, 1970s and 1980s.

Fearing the emergence of a specie gold-based economy separate from central banking, and with the corresponding threat of the collapse of the U.S. dollar, the U.S. government approved several changes to the trading on the COMEX. These changes resulted in a steep decline in the traded value of precious metals from the early 1980s onward.

In September 1987 under the Reagan administration the U.S. Secretary of the Treasury James Baker made a proposal through the International Monetary Fund to use a commodity basket (which included gold).[citation needed]

Silver standard

United States silver certificates were a type of representative money printed from 1878 to 1964 in the United States as part of its circulation of paper currency.[8] They were produced in response to silver agitation by citizens who were angered by the Fourth Coinage Act, and were used alongside the gold-based dollar notes. The silver certificates were initially redeemable in the same face value of silver dollar coins, and later in raw silver bullion.

Since the early 1920s, silver certificates were issued in $1, $5, and $10 notes. In the 1928 series, only $1 silver certificates were produced. Fives and tens of this time were mainly Federal Reserve notes, which were backed by and redeemable in gold. In 1933, the Agricultural Adjustment Act was passed, which included a clause allowing for the pumping of silver into the market to replace the gold. A new 1933 series of $10 silver certificate was printed and released, but not many were released into circulation.

In 1934, a law was passed in Congress that changed the obligation on Silver Certificates so as to denote the current location of the silver.

The last government regulation regarding the silver standard was in 1963, when President John F. Kennedy issued Executive Order 11110, authorizing the US Department of Treasury to issue silver certificates for any silver held by the U.S. Government in excess of that not already backing issued certificates. These redeemable silver certificates were issued for a short period in notes of $5, but they were eventually discontinued.

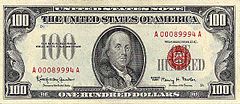

United States Notes

A United States Note, also known as a Legal Tender Note, was a type of paper money that was issued from 1862 to 1971 in the U.S. Having been current for over 100 years, they were issued for longer than any other form of U.S. paper money. They were known popularly as "greenbacks" in their day, a name inherited from the Demand Notes that they replaced in 1862.

While issuance of United States Notes ended in January 1971, existing United States Notes are still valid currency in the United States today, though rarely seen in circulation.

Both United States Notes and Federal Reserve Notes are parts of the national currency of the United States, and both have been legal tender since the gold recall of 1933. Both have been used in circulation as money in the same way. However, the issuing authority for them came from different statutes.[9] United States Notes were created as fiat currency, in that the government has never categorically guaranteed to redeem them for precious metal - even though at times, such as after the specie resumption of 1879, federal officials were authorized to do so if requested.

The difference between a United States Note and a Federal Reserve Note is that a United States Note represented a "bill of credit" and was inserted by the Treasury directly into circulation free of interest. Federal Reserve Notes are backed by debt purchased by the Federal Reserve, and thus generate seigniorage for the Federal Reserve System, which serves as a lending intermediary between the Treasury and the public.

Fiat standard

Today, like the currency of most nations, the dollar is fiat money, unbacked by any physical asset. A holder of a federal reserve note has no right to demand an asset such as gold or silver from the government in exchange for a note.[10] Consequently, some proponents of the intrinsic theory of value believe that the near-zero marginal cost of production of the current fiat dollar detracts from its attractiveness as a medium of exchange and store of value because a fiat currency without a marginal cost of production is easier to debase via overproduction and the subsequent inflation of the money supply.

In 1963, the words "PAYABLE TO THE BEARER ON DEMAND" were removed from all newly issued Federal Reserve notes. Then, in 1968, redemption of pre-1963 Federal Reserve notes for gold or silver officially ended. The Coinage Act of 1965 removed all silver from quarters and dimes, which were 90% silver prior to the act. However, there was a provision in the act allowing some coins to contain a 40% silver consistency, such as the Kennedy Half Dollar. Later, even this provision was removed, with the last circulating silver-content halves minted in 1969. All previously silver coins minted for general circulation are now clad. During 1982 the composition of the cent was changed from copper to zinc with a thin copper coating. The content of the nickel has not changed since 1946.[citation needed] Silver and gold coins are produced by the U.S. government, but only as non-circulating commemorative pieces or in sets for collectors.

All circulating notes, issued from 1861 to present, will be honored by the government at face value as legal tender. This means only that the government will give the holder of the notes new federal reserve notes in exchange for the note (or will accept the old notes as payments for debts owed to the federal government). The government is not obligated to redeem the notes for gold or silver, even if the note itself states that it is so redeemable. Some bills may have a premium to collectors.[citation needed]

The only exception to this rule is the $10,000 gold certificate of Series 1900, a number of which were inadvertently released to the public because of a fire in 1935. A box of them was literally thrown out of a window. This set is not considered to be "in circulation" and, in fact, is stolen property. However, the government canceled these banknotes and removed them from official records. Their value, relevant only to collectors, is approximately one thousand US dollars.[citation needed]

According to the Federal Reserve Bank of New York, there was $829 billion in total US currency in worldwide circulation as of December 2007.[11]

In September 2004, it was estimated that if all the gold held by the U.S. government (287.13 million ounces = 8.14 million kilograms = 8,140 metric tonnes) were again required to back the circulating U.S. currency ($733,170,953,704), gold would need to be valued at $2,800/ounce ($90/gram).

Information gathered from Wikipedia.

Tags:

Replies to This Discussion

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

2DF36465-A826-443C-A3A8-6638BC1D4FFA

2DF36465-A826-443C-A3A8-6638BC1D4FFA

Jacob Collier Improvises With Orchestra (Live in San Francisco)

Архітектура для мегаполісів: виклики та рішення урбаністики

FB_IMG_1770501160448

Something is Making Fishermen Disappear It’s not Alligators or Sharks

Always Wondering

© 2026 Created by truth.

Powered by

![]()