Ellen Brown: US economic reform creates full-employment, renewed infrastructure, zero national debt

May 28, 7:45 PM ·

Carl Herman - LA County Nonpartisan Examiner

http://www.examiner.com/x-18425-LA-County-Nonpartisan-Examiner~y201...

We hold these Truths to be self-evident...Attorney

and author of the brilliant Web of Debt, Ellen Brown, is

Carl Herman - LA County Nonpartisan Examiner

http://www.examiner.com/x-18425-LA-County-Nonpartisan-Examiner~y201...

We hold these Truths to be self-evident...Attorney

and author of the brilliant Web of Debt, Ellen Brown, is

Attorney and author of the brilliant Web of Debt, Ellen Brown, is among the leading US advocates of monetary reform and state-owned banks.

Among Ellen’s

articles is one worth highlighting for how quickly a national

economy can turn from ruin to astounding productivity: Nazi Germany’s

direct creation of money to pay for public goods and services.

This fundamental shift allows central government to create debt-free money to pay for full-employment and renewed

infrastructure. In addition, if the infrastructure investment causes

greater overall productivity than its cost (historically true), then

society has the included benefit of decreasing prices.

infrastructure. In addition, if the infrastructure investment causes

greater overall productivity than its cost (historically true), then

society has the included benefit of decreasing prices.

The monetary system we still have today doesn’t create debt-free money; it allows privately-owned

banks to create loans (credit, not money) that along with its interest

cost causes societal ever-increasing and unpayable debt. The US national

debt is ever-increasing; no political “leader” speaks of the obvious

and only solution: stop having and increasing a national debt-supply

rather than a money-supply and create a money-supply to pay the debt

(details here).

banks to create loans (credit, not money) that along with its interest

cost causes societal ever-increasing and unpayable debt. The US national

debt is ever-increasing; no political “leader” speaks of the obvious

and only solution: stop having and increasing a national debt-supply

rather than a money-supply and create a money-supply to pay the debt

(details here).

As Ellen explains in detail below, Germany suffered from tragic-comic hyperinflation caused by a privately-owned

central bank and short-selling of the nation’s currency, and high

unemployment; three central features of our “modern” economic system

today. As soon as Germany created a form of money in exchange for

productive goods and services, the government could respond to the

market failure of unemployment while addressing the nation’s public

service needs.

central bank and short-selling of the nation’s currency, and high

unemployment; three central features of our “modern” economic system

today. As soon as Germany created a form of money in exchange for

productive goods and services, the government could respond to the

market failure of unemployment while addressing the nation’s public

service needs.

Of course, the point of this article is not a history lesson, but an application of history to the US economy of the

present. Full-employment is possible and available now as a policy

response (details here).

present. Full-employment is possible and available now as a policy

response (details here).

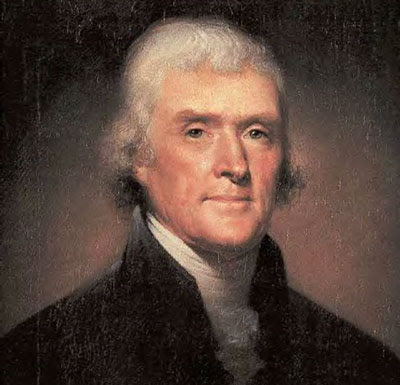

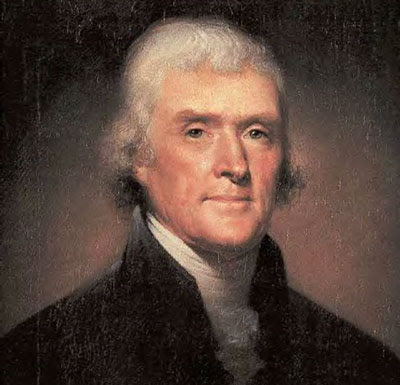

The idea of government-created money has been advocated by many of America’s

brightest historical minds; the absence of its consideration in

“leadership” conversation, I assert, is evidence that the US is under an

Orwellian government that has chosen the economic policies of an

oligarchy rather than the public good. That’s a cognitive dissonance

evoking conclusion, I understand, but the evidence to prove it is

here if this topic of trillions of our dollars is of sufficient

interest for you.

brightest historical minds; the absence of its consideration in

“leadership” conversation, I assert, is evidence that the US is under an

Orwellian government that has chosen the economic policies of an

oligarchy rather than the public good. That’s a cognitive dissonance

evoking conclusion, I understand, but the evidence to prove it is

here if this topic of trillions of our dollars is of sufficient

interest for you.

Ellen Brown and I agree that a powerful entry-point to break open the oligarchy is through state-owned banks.

This allows opportunity for state government (or county, city,

university, etc.) to use existing bank law to create credit at cost. The

only solvent state in the US today, North Dakota, uses this strategy. I

recommend perusing Ellen’s articles to

understand further. Ellen is interviewed in and consulted for the

creation of the outstanding economics film, Zeitgeist Addendum, below.

This allows opportunity for state government (or county, city,

university, etc.) to use existing bank law to create credit at cost. The

only solvent state in the US today, North Dakota, uses this strategy. I

recommend perusing Ellen’s articles to

understand further. Ellen is interviewed in and consulted for the

creation of the outstanding economics film, Zeitgeist Addendum, below.

Here’s her article of how quickly a nation’s economy can become powerfully productive. Of course, economic power is amoral and must be focused with policy for productive

ends.

http://www.webofdebt.com/articles/bankrupt-germany.php

ends.

THINKING OUTSIDE THE BOX:

HOW A BANKRUPT GERMANY SOLVED ITS

INFRASTRUCTURE PROBLEMS

Ellen Brown, August 9th, 2007http://www.webofdebt.com/articles/bankrupt-germany.php

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

"Cheeki kea, I pray that the insanity doesn't deepen and there's been an attack by some 18…"

21 hours ago

Disgraced Former CNN Anchor Don Lemon Arrested

No longer an employed journalist, Don Lemon had been seen with far left agitator, Nekima Levy…See More

yesterday

"Good poem for these times. I think it's only going to get worse though as we enter into the…"

Tuesday

Our Crazy Modern World

I'll be your host tonight in our first episode of "Our Crazy Modern World". Join us now!Apparently…See More

Sunday

"What a bummer. Can't tell thie 'dead' guy to eat shit now."

Saturday

2DF36465-A826-443C-A3A8-6638BC1D4FFA

"Venezuela under Chavez had cut ties with the IMF and World Bank. He had suggested that the US had…"

Saturday

G_LrzqtXMAAhT7w

"Derelict of duty should be reason for removal of these judges. That would go against what is in…"

Saturday

2DF36465-A826-443C-A3A8-6638BC1D4FFA

"You can't subvert a nation that has already been subverted by Marxists and drug cartles who…"

Feb 11

© 2026 Created by truth.

Powered by

![]()