silver manipulation

Dear Money Morning Reader,

The all-time high price for silver is $50.35 an ounce...

That price was reached in 1980 - more than 30 years ago.

Silver is at an important tipping point right now. We received a lot of questions from readers who don't know how to play silver, or leverage the big run-up we believe is coming.

Our report below has all the details. I urge you to read it carefully, while there's time to take advantage of what's in store.

Sincerely,

![]()

Mike Ward

Publisher, Money Morning

A massive scheme involving powerful banks...

secret informants... perhaps even the

federal government... is converging right now...

And it's about to push silver past $200...

Dear Reader,

I'm Peter Krauth.

Most people have little idea what's been going on behind the scenes in the silver market.

But as a global resource specialist, I've been rubbing shoulders with the speculators... miners... traders... and "insiders" who set and move the price for metals like silver for over 30 years.

The event I'm about to tell you about is so outrageous, it will raise the hairs on the back of your neck.

Yet it's creating an opportunity of unprecedented size - at a time when few opportunities exist.

It stems from a massive scheme that appears to involve traders... investment banks... and, as some suggest, even the COMEX and the federal government itself.

It's so big, it could put the Hunt Brothers attempt in 1973 to actually "corner" the silver market to shame.

Once you see the details of this current event, you'll understand just how big this opportunity is.

And it was all triggered by a trader named Andrew Maguire... his testimony to the CFTC... and a class-action complaint against the biggest financial players in the silver market.

It was filed as Case No. 8157...

This situation could be ripped from the pages of a Hollywood thriller, except for one difference. This story is not fiction... and it's happening now.

It all starts with the increasing scarcity of silver. According to some, the world has consumed so much silver in the past few decades that supply has collapsed by 95%.

it is today since the year 1300 A.D.

At the same time, demand for silver is increasing at an alarming rate.

And yet... the shocking truth is that the price of silver has dropped like a rock.

It defies all reason... because reason and fair trade have nothing to do with it...

And it raises questions like...

Nobody admits to knowing every last detail, but I'll try and sort it out for you here.

And amid all the questions, one thing is clear... it's all about the money.

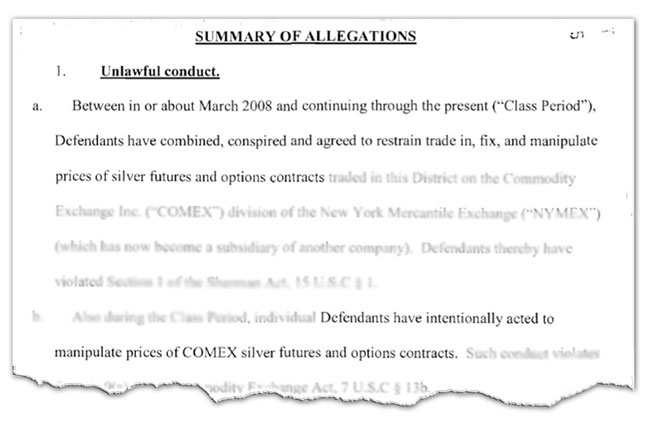

According to Maguire and a class-action complaint, between 2008 and 2011, this scheme allegedly raked in billions of dollars in windfall profits for the big players, all by keeping the price low...

At the expense of ordinary people like you and me who were left wondering how in the world the price of silver could decline...

- Even while the electronics boom is devouring more silver than at any time in history...

- Even while billions of citizens in China and India are buying and hoarding silver like crazy.

This report will answer that question for you.

You'll also clearly see why this scheme is finally collapsing...

Many believe a lot more.

Most importantly, you'll see how you can use this information for yourself, in a completely legal and ethical way, for a chance to reap extraordinary profits from silver.

The kinds of gains I'm talking about are large... could be extremely large. In fact, the last time something like this happened, investors pocketed upwards of 195% in just a few months.

If we use similar ratios - or if you choose to "leverage" these gains with a simple move - the gains could possibly be two to three times that size.

I have to warn you right here. The story you're about to hear is alarming. It's an outrage.

The allegations are huge. Here are just a few...

If you're not prepared to hear the shocking details - and to take action to turn this to your advantage - then please click out of this report now.

Andrew Maguire worked on the London Metal Exchange trading silver through the COMEX (the world's foremost exchange in Chicago) for more than 40 years. He spent his life in the trenches with the biggest silver futures traders in the world.

During the summer of 2008, he sensed something was going very wrong. It began about the time JPMorgan acquired Bear Stearns in March of that year...

In the purchase, Morgan took on Bear's enormous short positions on silver; that is, their billion-dollar bets that the price of silver would fall. And if it did, they would make a vast fortune.

The only problem was this: On the very day that Bear went out of business - March 16, 2008 - silver reached a multi-decade high of $21 an ounce.

For anyone who owned these bets... when the price of silver is rising... well, that's not a good position to be in.

The losses can be devastating - enough to push a trading unit (even a whole company) into bankruptcy, just like it did for AIG.

unit (even a whole company) into bankruptcy, just like it did for AIG.

But within days of JPMorgan taking over these massive shorts, silver plummeted almost 17%. And over time, Morgan allegedly added heavily to that "short" bet.

Take a look at the chart to the right.

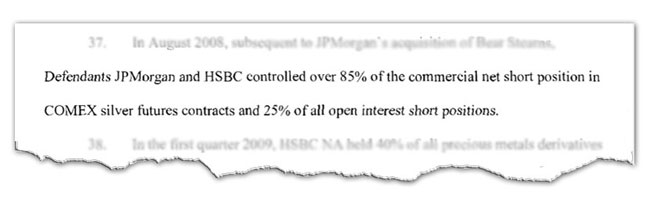

According to the original complaint, Morgan, along with another international bank, allegedly controlled over 85% of the commercial net short positions in silver futures contracts on the COMEX, as you can see below.

On the surface, it looked almost crazy. Every uptick could turn into losses of hundreds of millions - even billions - of dollars.

Yet by August 5, 2008, the suit claimed they were short 33,805 contracts - borrowed contracts that they would have to buy back at a lower price or else lose their shirts. They were potentially on the hook for a mind-numbing 169 million ounces of silver.

That would be equal to 20% of the entire world's annual mine production, or the entire COMEX warehouse stockpile, the second largest inventory in the world.

Somehow, they were very "fortunate." That is, if you can bend fortune to your will.

From March 16 onward, the price of silver began to decline, directly in their favor.

And it continued to sink. Like a stone.

As you can see from the chart below, between July 14 and August 15, 2008 the price of silver declined from a peak of $19.30 to a low of $12.82 for a loss of 33%.

Then it hit rock bottom...

By October 2008, the price of silver was barely $9. The price of silver had been driven right into the ground. On the surface, the move was so irrational it defied all reason.

For ordinary silver investors, the drop was catastrophic.

But, according to an amended class-action complaint filed in U.S. Federal court against JPMorgan...

$220 MILLION in just 1 day? If true, imagine the profit potential of the entire 7-month freefall.

Maguire was aware that the CFTC, the organization that regulates precious metal trading, had already started an investigation into JPMorgan and potential silver manipulation.

But the CFTC investigation was getting nowhere. And Maguire thought he could help.

So, in November of 2009, he signed on as an informant.

According to e-mails Maguire released publicly, Morgan's traders allegedly devised a plan to invite their "outside" trader friends to get in on the action by sending "signals" just prior to a big move.

Most experts agree that by "hitting the bids" hard with their enormous cash reserves, they had the potential to absorb any uptrend in price and get the desired results for their massive short contracts.

Again, the class action complaint states as much...

Whatever they may have done, the price of silver went down... and kept going down. Even while demand was increasing at near-exponential rates.

And it netted some traders profits, big profits. Some estimates are in the BILLIONS of dollars between June 2008 and March 2010.

Of course while the traders were getting rich... holders of smaller silver positions were suffering staggering losses as the price of silver was inexplicably suppressed.

And that's what really bugged Maguire.

On Feb. 3, 2010, Maguire e-mailed the commodity futures trading commission. He described two impending "manipulation events" that he had been told would occur two days later, when the Labor Department's non-farm payroll numbers would be released.

On Feb. 5, Maguire wrote another e-mail confirming that "silver manipulation was a great success and played out EXACTLY to plan as predicted." He added,

What happened next, though...

On March 26, 2010, Maguire saw the squealing car come careening out of a side road while he pumped gas into his own car at a London service station, his wife sitting in the passenger's seat. But it was too late.

The unidentified car plowed directly into Maguire's auto, almost killing him and his wife.

The mysterious car then sped on, smashing two other cars and nearly killing a pedestrian before it swerved back onto the road at high speed.

Armed with chase cars and helicopters, an army of London police pursued the would-be killer. And they ultimately nabbed the culprit.

Yet, strangely, their attacker's identity or whereabouts have never been disclosed.

In the face of lawsuits and negative press surrounding the accusations, JPMorgan "quietly reduced" their massive silver short position in August 2010.

Could it be coincidence that almost immediately, between September 2010 and April 2011, the price of silver TRIPLED from around $16 an ounce to more than $48 an ounce?

In just those 8 months, from September 2010 through April 2011...

That would have been 7.5 times more growth than the S&P 500 returned over the exact same time period.

Now, if you're like me, you'd take a TRIPLE in a heartbeat.

The reality is... those are small gains compared to what's on the horizon.

Biggest Silver Run in History

Reeling from huge losses in the silver squeeze that began in September 2010, it appears that the market movers decided to try and stop the bleeding by resorting to their old tricks.

In March 2011, JPMorgan's net silver short position, which had decreased by 11,000 contracts over the preceding three months to 19,000, suddenly ballooned to 25,000 contracts.

And without warning, on May 2, 2011, silver was attacked by short sellers once again.

Some analysts believe the margin increase was timed to keep the massive short positions from losing money. No one can prove it - yet. Still, it's a juxtaposition of events that cannot be accounted for. After all, 43 million ounces were held in short positions... in a market that was heading higher once again...

That's when the initial margin requirements skyrocketed from $11,745 to $21,600 - a whopping increase of 84%.

Thousands of investors had to dump their silver holdings like hot potatoes; at any price they could get; no matter how low or how much money they would lose.

In a summer of 2011 interview with Silver Invest News, Eric Sprott, CEO of Sprott Asset Management LP, with $8.5 billion under management, and one of the foremost experts in the metals market, declared it to be manipulation plain and simple.

Sprott went on to say,

Yet despite all this, silver has withstood the attacks. Right now it's just re-loading.

As Ben Davies, CEO of Hinde Capital explained in August of last year to King World News:

So what's next?

We believe silver would be fairly priced at over $200 an ounce.

There are four things you need to know to profit from this opportunity:

- How to play the price of silver straight up. On a one-for-one basis. We believe silver can move from around $30 an ounce to over $200. That's a gain of approximately 660%... Play it straight up with physicals, or use a specific ETF. We'll show you how...

- The Chance to double the move on the price of silver. We're looking at a specific fund that's structured to double the move on silver. It even compounds for you. You don't invest on margin, and you don't need to worry about margin calls. That's all internally managed and packaged within the units. It's a simple one-stop silver opportunity. In the last run I mentioned, this unique fund produced gains of 570%.

- How to pick a "sleeping giant" silver producer. You'll definitely want to look at a solid company already pulling silver out of the ground. Since their cost is mostly fixed and financing settled, every uptick in silver becomes nearly pure profit. So the gains to these companies could be quite substantial. We have one of the best in the business in mind. As silver continues its rise, as we believe it will, then the company is set for a 50% gain within 12 months, and a double or better by the end of 2013.

- Ratchet up your gains with "in-ground" silver. What we recommend is a company that has huge reserves in the ground, but that's not yet producing. This company did in fact produce over 1 million silver ounces in the past year. Yet its newer find has just received its final permit, and will begin producing in Q2 2012. At full production, this find will triple the company's current silver production to 5.5 million ounces annually. It will also be the second largest silver producing mine in the U.S., producing about 10% of all U.S. silver.

You can get the full report at no cost to you. You'll see exactly how in a moment. It's called: The Profit Squeeze: How to Ride Silver as it Climbs to $200.

Now, at this point, there are two questions astute readers need to ask:

And Two, why won't the major players just have their way and continue to put the squeeze on the average investor?

When analysts need to assess the global demand for silver, they turn to GFMS Ltd. and The Silver Institute. These two organizations are the "gold standard" for above-ground supply, inventory and usage statistics.

Yet by their own admission, GFMS and The Silver Institute acknowledge that their reported data for "implied net investment" (that means institutional and retail demand for physical silver) is not an "observed" figure.

When you strip away the jargon, it means one thing:

Just recently, silver expert Eric Sprott discovered that the actual demand for silver, especially for investment, has been staggeringly underreported.

As you can see from his chart to the right...

As you can see from his chart to the right...

More than 225 million ounces of silver demand was "missing" from figures for the decade-long stretch that ended in December 2009.

And that figure doesn't include the demand from 2010, where the amount of trading in silver to ETFs and other investing vehicles was, according to Sprott, approaching 800 million ounces - a day!

You see, at the same time, demand for silver is on the cusp of hitting historical highs.

Silver's use in industrial applications increased 20.7% last year to 487 million ounces.

That means as much as 50% of silver's total annual production is for industrial use... and that number is expected to rise another 36% by 2015.

As the world's greatest conductor of electricity - manufacturers use silver to make switches and fuses found in washing machines, computers, vacuum cleaners, drills, dryers and ovens.

In addition, billions of silver-zinc batteries are manufactured every year for use in dozens of electronic devices such as cameras, remote control car keys, TVs and watches.

The list of products that need silver is enormous - and constantly growing... including the two biggest areas of all:

- Photovotaic cells used in smart phones (1.6 billion cell phones were sold last year)...

- Silver's recent ascent as a leading antibacterial agent being used by hospitals and healthcare facilities around the world. Today, you can even buy silver imbedded band-aids.

Yet amazingly, silver prices remain well below the all-time high of $50.35...

In addition, the supply of silver is on a downtrend of historic proportions.

And that doesn't even tell the whole story. Did you know that unlike gold, silver is 98% consumable? Most people don't.

What that means is:

(By comparison, of the 5 billion ounces of gold ever mined, about 2 billion are available above ground in bullion form.)

That's because the rest has been consumed. Most silver, such as the metal used in electronics, is not recoverable. There's no viable way to get it back for reuse.

In 1970 it is said there were 140 months of available above-ground silver, and by 1990 that shrank to 50 months. By 2010 it shriveled to perhaps as little as 11 months.

Even more telling...

- The amount of silver coming out of the ground is going down every year...

- Few, if any new discoveries have been announced in the past 10 years...

- Most silver comes out of the last stages of existing mines (with the exception I mentioned above)...

- The quality of silver mined is the lowest it's ever been... And...

- Like most metals, silver isn't mined in veins anymore. It takes many tons of earth and rock to process even an ounce...

The details on supply and demand can fill whole books. Bottom line: Silver is in demand... It's harder to get... And manufacturers and investors will be paying through the nose to own it.

We're not foolish enough to believe that the market will not be gamed again for the gain of big institutions. I believe it would be one of the finest days in America if that were the case.

Sadly, if money can be made bending the rules, it will be done. In the evolution of rigged markets, the next ingenious scheme has not even been thought of yet.

But there are two big changes right now that you need to know about.

These two new developments will likely free the price of silver (for a time, anyway) and make this historic run-up possible.

The first game changer is building steam and getting bigger by the day. It has certain players running scared. Yet it's playing right into the hands of those savvy enough to get in early.

For years, there's only been one game in town. If you wanted to buy or sell silver contracts you had to trade through the Chicago Mercantile Exchange (CME).

If you're not familiar with the CME, they also run the NYMEX (the world's largest physical commodity futures exchange), the COMEX (the global exchange for gold, silver, copper and aluminum) and the CBOT (for trading options and futures contracts on a wide range of products including gold, silver, U.S. Treasury bonds and energy).

They even control the Dow Jones Industrial Average.

Outside of the U.S. it's seen as a monopoly because...

1. You have to trade in dollars.

2. You have to abide by their rules.

Everybody. Throughout the world. No exceptions.

That means that China has been shut out from taking delivery on silver - unless they purchased contracts through the CME.

Yet the recently opened Hong Kong Mercantile Exchange is about to rewrite the book for silver buyers around the globe. It's going to make it very rough for the schemers to use their same tricks.

You see, this is the first time in history that the Chinese (and silver investors all across Asia) can purchase silver futures contracts... and actually take delivery of the metal - in Hong Kong no less.

There's little doubt that this will quickly become the gateway to silver into China - and likely all of Asia.

No longer will the enormous Asian market have to answer to Wall Street when it comes to buying silver.

Take a second to think how much of an impact this could very well have on the silver market.

Today the Chinese are the biggest consumers of silver on the planet - accounting for an astounding 23% of global silver consumption last year!

In fact, in 2010 silver demand rose 67% in China alone. And this number is expected to increase dramatically in the next several years.

And even better: It comes at a steep discount too.

You see, for those who want to trade silver futures contracts, the new Hong Kong Merc only requires investors to buy "in" with a 1,000 troy ounce minimum.

This is dramatically less than what is required back in the states where the minimum contract allowed by the CME is 5,000 troy ounces.

What's more, the Hong Kong Merc has signed up a whopping 22 of the biggest brokerage trading firms in Asia.

It's already setting up a squeeze with the potential to be one of the biggest in the history of silver.

Hard-money heavyweights including Ben Davies of Hinde Capital, Jim Rickards of Tangent Capital Markets and QB Asset Management Co-founder Paul Brodsky have predicted at least another double in silver in a few months alone.

By some estimates, silver could well return 10 times investors' money for the early crowd.

Think about what that could mean...

In just a few, short months... maybe even before the snow melts... a hypothetical...

$5,000 could become $10,000... or $35,000 or $50,000

$10,000 could become $20,000... or $70,000 or $100,000

$25,000 could become $50,000... or $175,000 or $250,000

THAT'S A POTENTIAL QUARTER MILLION DOLLARS... on top of holding one of the world's most treasured commodities.

While the impact of the Merc is expected to outmode the schemers and skyrocket silver prices, another development is making this pressure cooker for silver prices explode.

(PAGE) Blows It Open

The Pan Asia Gold Exchange (PAGE) is about to open soon. Estimates are by June 2012...

Again, please commit this date to memory: June 2012. It could be one of the most significant moments in financial history. A moment that can put a decade of market misery behind you.

PAGE will enable all 320 million retail customers – and 2.7 million corporate customers – of the giant Agricultural Bank of China to simply use their Renminbi, the Chinese currency, from their bank accounts to trade gold and silver.

This no doubt is an historic event.

Here's how Andrew Maguire recently described the scenario to King World News:

"I believe the leveraged and naked existing short side concentration in silver will be blind-sided by this.

"None of this potential new physical demand has been factored in by analysts and I expect a large and unanticipated drawdown of physical gold and silver over the next few months, ahead of the international contracts going 'live.'"

Maguire continued:

"This factor will ultimately destroy the remaining short positions in both gold and silver... In my opinion it will create a massive short squeeze."

So what happens when silver is finally unfettered? How high could it run?

We believe that initially, $200 per ounce silver would be a fair value. And we're not alone.

Renowned gold industrialist, Rob McEwen, recently explained to Mineweb.com that as gold goes up... and if you use the 16 to 1 ratio... "$200 is conservative."

And Peter Schiff, CEO of Europacific Capital told King World News:

And how much could you make on the upcoming squeeze? Well, quite a lot.

Take a moment right now and get our report: "The Profit Squeeze: How to Ride Silver as it Climbs to $200."

Find out:

- How to play the price of silver straight up for potential gains up to 660%...

- How to double the run on silver for twice those gains...

- How to pick a "sleeping giant" silver producer set for as much as a 100% spike in 2012...

- How to ratchet up your gains on "in-ground" silver, for even larger returns.

The report is free, as a special gift to you. You'll see how to get it in a moment.

And if there's any doubt that now is the perfect time to buy silver, consider the man who's making a $1.5 billion bet on it... Eric Sprott, perhaps the smartest silver investor on the planet.

When it comes to silver, Sprott had this to say to Financial Sense:

In fact, he recently filed a prospectus for the purchase of an additional $1.5 billion worth of silver bullion to cover expected demand for his company's exchange traded fund.

Frankly, you don't invest that kind of money on a whim. You only invest that kind of money when you firmly believe there's going to be a payback.

That's why it's so important to get our latest report: The Profit Squeeze: How to Ride Silver as it Climbs to $200. You'll find out about the chance to see potential gains of 660% and more on the impending run.

I'd like you get this. If the run begins, $1,000 could quickly turn into $6,000 or more, depending on how you choose to play it.

The story of Andrew Maguire... the inexplicable pricing of silver... and the movement of capital is a great example of how vital it is to have complete, behind-the-scenes information before making any move.

It's also a great example of how those with that information can make a ton of money.

When you understand the entire "back story," silver is clearly one of the most powerful weapons you could have in your arsenal if you're going to come out ahead in today's rocky markets.

But it's not the only one. Not by a long shot.

To be fully equipped to THRIVE in this ever-changing global economy...

- You need to have your pulse on the hottest trends in energy... technology... currency... commodities... and even politics.

- You need to know where the big money surges are headed - from investment banks, governments, industry and private investors - way before anybody else.

- You need to know not just what's going on in America... but around the globe.

- And you need to know exactly WHEN to get in, and more importantly... WHEN to get out.

Not an easy task. Virtually impossible for most.

But that's precisely what you get every month from our team here at Money Map Press in our flagship publication, The Money Map Report.

It's like a step-by-step treasure map, guiding you into - and safely out of - the very best moneymaking opportunities of today and tomorrow, no matter where in the world they arise.

Comment

-

Comment by Maria De Wind on February 26, 2012 at 10:12pm

-

Buy Physical and forget about certificates at all

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

Ключові слова в тексті: як органічно їх вписати в статтю

Orwell - Football, Beer & Gambling

I, Pet Goat VI by - Seymour Studios | I, Pet Goat 6

Official Trailer NOVA '78 directed by Aaron Brookner and Rodrigo Areias

Peter Sellers - The Party (opening scene)

Disgraced Former CNN Anchor Don Lemon Arrested

© 2026 Created by truth.

Powered by

![]()

You need to be a member of 12160 Social Network to add comments!

Join 12160 Social Network