Goldman Sachs denies 'betting against clients'

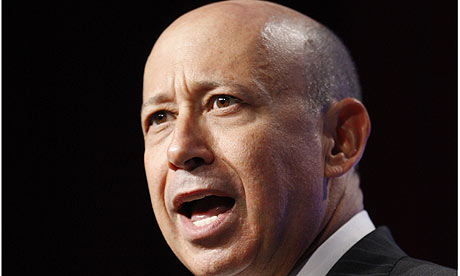

Wall Street bank issues eight-page letter to shareholders justifying its conduct before, during and after the financial crisis.

"I'M DOING GOD'S WORK!"

Nine months after being labelled "a great vampire squid wrapped around the face of humanity", Goldman Sachs has issued a wide-ranging justification of its conduct before, during and after the financial crisis.

In a letter to shareholders issued alongside Goldman's 2009 annual report, the Wall Street bank denied that it "bet against its clients" when it changed its position in the housing market in 2007, shortly before

prices began to collapse.

The eight-page letter, signed by chief executive Lloyd Blankfein and president Gary Cohn, also contained a detailed defence of the $12.9bn (£8.5bn) payout which Goldman received

from AIG after the failed insurance giant was bailed out by the US

government.

The letter appears to be a detailed response to some of the allegations made nine months ago by Rolling Stone journalist Ma.... His article, which argued that Goldman had repeatedly profited by inflating unsustainable financial bubbles, received widespread

coverage. It included the claim that the company was "a great vampire

squid wrapped around the face of humanity, relentlessly jamming its

blood funnel into anything that smells like money".

One of Taibbi's key charges was that Goldman had helped to fuel the housing boom during the last decade by packaging hundreds of millions of

dollars worth of housing loans into complicated financial products such

as collateralised debt obligations (CDOs). These CDOs were sold on to

other banks and investors such as pension funds, who suffered big

losses when the sub-prime housing bubble burst. Goldman, though,

actually profited from the fiasco by short-selling the market before

the credit crunch struck in summer 2007.

In the letter, which includes the word "clients" 56 times, Blankfein and Cohn attempt to rebut this charge. They admit that Goldman "went short"

in the housing market while simultaneously continuing to trade

mortgage-backed securities to its clients. They deny, though, that this

was wrong, arguing that various sophisticated investors simply took

differing views.

"We certainly did not know the future of the residential housing market in the first half of 2007 any more than we can predict the future of markets today. We also did not know whether

the value of the instruments we sold would increase or decrease. It was

well known that housing prices were weakening in early 2007, but no one

– including Goldman Sachs – knew whether they would continue to fall or

to stabilise at levels where purchasers of residential mortgage-related

securities would have received their full interest and principal

payments," they wrote.

"Although Goldman Sachs held various positions in residential mortgage-related products in 2007, our short positions were not a 'bet against our clients'. Rather, they served to

offset our long positions. Our goal was, and is, to be in a position to

make markets for our clients while managing our risk within prescribed

limits."

'An inside job'

Goldman was the biggest beneficiary from the US government's bailout of AIG in autumn 2008. Goldman claimed at the time that its exposure to AIG was "immaterial", but in March 2009 it emerged that it actually received $12.9bn of the $44bn handed to... who had taken out insurance contracts with AIG.

Some critics have questioned whether then-Treasury secretary Hank Paulson – who was Blankfein's predecessor at Goldman – acted properly by authorising the payment of

an estimated $90bn of taxpayer funds to various banks. The rescue came

just a few weeks after the US government allowed Lehman Brothers – a

key Goldman rival – to fail.

Today's letter lays out in some detail why Goldman received so much from the collapse of AIG. They said that $4.8bn of the money was paid in return for securities which could

otherwise have been sold for the same price, while $2.5bn covered

existing debts owed because of the deteriorating market.

Another $5.8bn was handed over to settle credit default swaps, or insurance contracts, on the CDOs that had helped to create the crisis. These CDS

contracts were settled at face value, rather than at a discount to

reflect the fact that the counterparties could have faced a lengthy wait to recover any m....

Eliot Spitzer, the former governor of New York, called Paulson's decision to fulfil AIG's CDO contracts in full a "disgrace".

"The appearance that this was all an inside job is overwhelming. AIG was nothing more than a conduit for huge capital flows to the same old

suspects, with no reason or explanation," Spitzer wrote last year.

Blankfein and Cohn insisted that "the vast majority of the money we received" was used to buy back the underlying bonds. They admitted, though, that they

and the rest of the financial system benefited significantly from the

rescue of AIG.

"Although it is difficult to determine what the exact systemic implications would have been had AIG failed, it would have been extremely disruptive to the world's already turbulent

financial markets," they wrote.

Tags:

Replies to This Discussion

-

Permalink Reply by Marklar on April 9, 2010 at 10:50am

-

Goldman: We Are Not "Vampire Squid Wrapped Around Humanity´s Face".

Then put your probiscus away and step back!

-

Permalink Reply by fireguy on April 9, 2010 at 11:19am

-

Didn't Hitler say he was doing god's work?

These Banker Bastards are getting their rewards ($$$$) now but they will pay, soon.

GOLDMAN SACHS PUBLIC ENEMY #1

http://behindthematrix.wordpress.com/2009/05/05/goldman-sachs-publi...

HOW GOLDMAN SACHS (ROTHCHILDS) TOOK OVER THE WORLD

http://behind-the-matrix.blogspot.com/2009/04/how-goldman-sachs-rothschilds-took-over.html

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

Death of an F-106 Pilot in Pursuit of the Unknown

The Re-Evaluation of our Current Reality

Source: Havana Syndrome investigation is "a massive CIA cover-up" | 60 Minutes

Regrets That Cling to Me

Reality Is now Becoming Unhinged

Ghislaine Maxwell & The Secret "Shadow" 9/11 Commission? | John Kiriakou

Ghislaine Maxwell & The Secret "Shadow" 9/11 Commission? | John Kiriakou

When the Communists Take Over America!...Famous 1957 Anti-Communist Movie

When the Communists Take Over America!...Famous 1957 Anti-Communist Movie

© 2026 Created by truth.

Powered by

![]()