China Under Attack – as World Markets Plummet with Gold Standard Threat - WWIII?

Two gigantic explosions, followed by multiple smaller ones; killing at least 44 (at the time this was written) people and injuring over 700 more and with 36 fireman missing – went-off at a "dangerous goods" warehouse in the Binhai New Area, on the city’s coast just outside the wealthy region of Tianjin, China - at about 11.30pm local time on the 12/8/2015. Both the final death toll and numbered of injured is believed to be much higher.

This seems like something straight out of the 2015 film Blackhat; where at a nuclear plant in Chai Wan, Hong Kong, a hacker causes the coolant pumps to overheat and explode. Not long after in Chicago, the Mercantile Trade Exchange gets hacked, causing soy futures to rise.

The Chinese government and the FBI determine that the hack was caused by a "Remote Access Tool" (RAT), and a bit like what I claim is also happening with "hacked" aircraft such as MH370 and MH17 where the controls are being taken over by the "hackers" by remote control and leaving the pilots helpless and unable to communicate or fly the aircraft. - In Hong Kong, the team traces the stock trade money to a known paramilitary named Kassar.

Flights MH17, MH370, AIRBUS-320, ATR43-300 "Remote Control"

These massive explosions were recorded by seismologists, this first was equivalent to about 3 tons of TNT, whilst the second blast was much larger and equal to 21 tons of explosives going off!

This has happened within hours of China announcing their decision to devalue its currency. This not only caught many experts off guard, it has sent the worlds markets into turmoil; the London Stock Exchange fell -228.87 on hearing the news and then a further -93.35 points on the 12th August 2015, the three major U.S. stock indexes were seen to plummet, while the German DAX and the French CAC 40 both fell more than 2%. With such tragic news hitting Chinese province speculators are probably hoping to see a temporary rise in the opening of the markets this morning 13th August 2015.

Rumours are already flooding social media with the speculative suggestion that this was a deliberate attack on China - a pre-warning - that if they continue in this economic vain, there could be far more severe consequences to pay. No one knows for sure, though with the trouble in Ukraine, China's allegiance to Russia and that any attempt for a country to start playing around with the gold-standard has always led to war - so perhaps there's good reason to think along these lines.

This is because the West and particularly the USA, fear not only China’s closer links to Russia, but they are also preparing to introduce a Chinese Gold-Standard and what hit the headlines less than three weeks ago on the 24th July 2015. Which so happens to be the same date when in 1943 – World War II - Operation Gomorrah begin; British and Canadian airplanes bombed Hamburg by night whilst American planes bomb it by day.

By the end of the operation in November, 9,000 tons of explosives will have killed more than 30,000 people and destroyed 280,000 buildings.

It was also when the Communist Party of China (CPC), the founding and ruling political party of the People's Republic of China (PRC), became allies of Marxist Russia.

Just as America displaced Britain as the world’s pre-eminent economic power in the interwar period of WWII, so, too, the large debts and fiscal pressures confronting the West, and the rise of China and other economic powers, have challenged the West to think about the future of finance.

On the outbreak of World War I, Britain abandoned the gold standard, though it was reintroduced in 1925.

This affected the price of goods in Britain and more crucially, wages were cut by 10% to maintain the competitiveness of British exports, and just like China has just announced. As a direct result American agricultural and industrial exports soared in the 1920s and 1930s and when the dollar effectively replaced the pound.

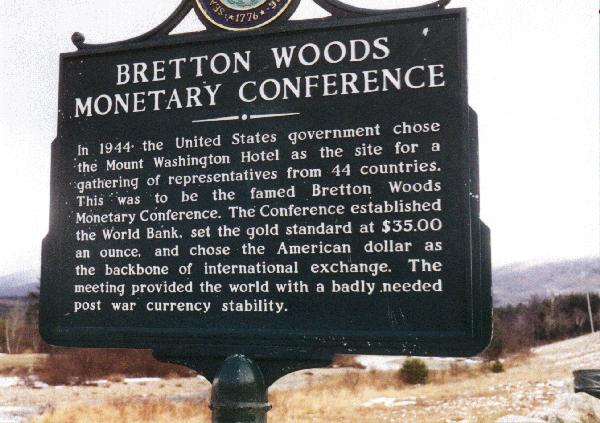

By the time of Bretton Woods, the United States held roughly 60% of the world’s gold supply. “Think of the gold in Fort Knox,” America’s chief negotiator at Bretton Woods, Harry Dexter White, said. “That is why we are in a powerful position.” He added, “We have the wherewithal to buy any currency we want.”

Bretton Woods fixed the dollar price of gold at $35 per ounce, and all the other major currencies — the pound, the franc, the mark, the Chinese yen — were subsequently pegged and dominated to and by the dollar, even though they could not be exchanged directly for gold. This system lasted until 1971.

America struggled to maintain gold convertibility at the old rate of $35 an ounce. So President Richard M. Nixon abandoned the fixed dollar price of gold established at Bretton Woods.

Critics said that the United States, by ending gold-standard dollar link, was turning its back on its responsibilities as the guarantor of the international monetary system. Over the time, the situation has gotten much worse. The United States is $17.6 trillion in debt.

Again it was only last month on the 17th July 2015, when China announced an increase in its gold reserves for the first time in more than six years. According to media reports, the People’s Bank of China (PBOC) increased its gold reserves “overnight” by 57%. The central bank’s gold holding now sits at 1.658 tonnes, making it the fifth biggest gold reserve in the world, surpassing Russia.

Let’s not forget it was WikiLeaks who allege that China is buying gold to weaken the US dollar's supremacy as the world's reserve currency on 13 September 2011, so this has been a gradual build-up.

The WikiLeaks cable was titled; "China increases its gold reserves in order to kill two birds with one stone". Taken together with recent policy announcements from Chinese banking officials, it may signal moves by China to eventually replace the US dollar as the world's reserve currency.

China’s has $4 trillion in reserves and in the past 25 years they have pursued a policy of aggressive export growth to drive their economy. China successively devalued its currency, from 1.50 renminbi to the dollar in 1980, to 8.72 in 1994 and now this recent devaluation renminbi and which the United States still considers artificially low.

This places China in the ideal position to peg its currency to gold. China is not as indebted as the West, but it is looking to “rebalance” its economy by raising demand by consumers, who want to enjoy the standard of living enjoyed across the Western world. Since 2010, the renminbi has appreciated 14% without hurting Chinese exports.

Experts say with a balanced budget and a gold-backed currency, China’s economy could be even more formidable than it is today. Such a move would truly mark its return as the “Middle Kingdom.” Hard as it may be to contemplate today, this scenario would, in many ways, be a more secure basis for an international monetary regime system than the system of floating exchange rates that Nixon inadvertently created in 1971, one that forever overturned the Bretton Woods order.

Politician and historian Kwasi Kwarteng, is the author of “War and Gold: A Five-Hundred-Year History of Empires, Adventures and Debt.” He shows that this moment in world history has been echoed many times, from the French Revolution to both World Wars, right up to the present day, when our own financial crisis saw many of our great nations slip into financial trouble. Kwarteng reveals a pattern of war-waging, financial debt and fluctuations between paper money and the gold standard, and creates a compelling study of the powerful relationship that has shaped the world as we know it, that between war and gold.

So are these recent explosions in the rich elite city of Tianjin, an “attack” on China to send out a warning that they better not get out of their pram and reintroduce a gold-standard to the worlds markets – or is it just another coincidence in a world where there are none, with the Chinese government saying it’s an “industrial accident” and an investigation is under way-way!

"Remote Control?" of Flights MH17, MH370, AIRBUS-320, ATR43-300 - All "Lost Contact" - http://12160.info/profiles/blogs/remote-control-of-flights-mh17-mh3...

Comment

-

Comment by Exposure on August 13, 2015 at 3:50pm

-

We had the same problem here and with the same member of the brotherhood cabal and where our corrupt Prime Minister sold off the UKs gold reserves - had he not done so then the country would not be in the debt it is today and with millions of people being forced to live under draconian austerity measures!!

-

Comment by Less Prone on August 13, 2015 at 3:11pm

-

In 1944 the Bretton Wood Monetary Conference set the gold standard at US$35 an ounce. Seventy year later gold ounce was worth US$1400, that is 40 times 35 dollars an ounce. It means the dollar had lost 97,5% of its value in seventy years. No one else but the usury cabal and their shills have benefited from this.

-

Comment by Exposure on August 13, 2015 at 2:46pm

-

I tend to agree with you Less Prone, always is the same cabal - the 1% elite are in all countries and those who own the industries of the MIC are like butchers who need meat eaters - they need constant wars - the bigger the better..

.

-

Comment by Less Prone on August 13, 2015 at 11:34am

-

Considering the transfer of technology and production from the "capitalist" west to the "communist" China, including the plundering of nuclear energy and weapons technology, I believe that China is controlled by the same usury cabal as the rest of the world. It is only a useful boogieman to make the people nervous and beg for government protection (enslavement) much like Osama bin Laden was.

-

Comment by Exposure on August 13, 2015 at 4:08am

-

As predicted and before the London Stock Exchange opened the markets have shot up; International Markets Index ValueChange FTSE 100 6,620.30 +49.11 FTSE 250 17,593.40 +155.31 FTSE 350 3,674.09 +28.14 FTSE All-Share 3,616.28 +26.94 FTSE AIM UK 50 4,008.43 +10.49 FTSE AIM 100 3,402.10 +9.61

"Destroying the New World Order"

THANK YOU FOR SUPPORTING THE SITE!

Latest Activity

- Top News

- ·

- Everything

I, Pet Goat VI by - Seymour Studios | I, Pet Goat 6

Official Trailer NOVA '78 directed by Aaron Brookner and Rodrigo Areias

Peter Sellers - The Party (opening scene)

Disgraced Former CNN Anchor Don Lemon Arrested

Our Crazy Modern World

© 2026 Created by truth.

Powered by

![]()

You need to be a member of 12160 Social Network to add comments!

Join 12160 Social Network